Ghana’s main stock index, the best performer in Africa this quarter, may soar another 40 percent this year as the start of oil production spurs the world’s fastest pace of economic growth, Exotix Ltd. said.

Exotix, the London-based brokerage that gets a quarter of its revenue from African securities and three quarters from frontier markets, said buy orders for Ghanaian stocks are up more than 50 percent from the start of the year, even after a 9.8 percent rally since March 31 drove valuations above the average for emerging markets. The country’s All-Share Index has a further 20 to 40 percent “upside” in 2010, according to Ashley Bendell, New-York-based frontier and emerging market equity broker at Exotix.

The west African nation’s equity market has been the most volatile globally. It soared 58 percent in 2008, beating all 93 national equity gauges tracked by Bloomberg, after its discovery of oil in 2007 and as crude jumped to a record $147.27 a barrel. The measure plunged 47 percent last year, the world’s worst slump, when crude tumbled to as little as $32.70 a barrel and Ghana’s currency depreciation triggered 20 percent inflation and a $1 billion International Monetary Fund bailout.

“The oil find has without a doubt brought a lot of interest,” Bendell said in an interview in Johannesburg.

Templeton Asset Management Ltd.’s Mark Mobius said in his blog on June 24 that he’s looking at Ghana along with South Africa, Nigeria, Egypt, Kenya, Botswana, Morocco and Tunisia for investment.

Too Small

Ghana’s index is rising as the IMF predicts a surge in economic growth to 20.1 percent in 2011, triple the average 6.5 percent for developing nations. The cocoa and gold exporter is scheduled to start pumping oil in the fourth quarter of this year. Oil has gained 75 percent since the beginning of last year to $78 a barrel.

The market remains too small to allow larger fund managers to buy and sell stocks, said Bryan Collings, who manages $1 billion in London-based Hexam Capital Partners LLP’s Global Emerging Markets fund. He has no holdings in Ghana and favors China and Brazil.

“I don’t think Ghana’s all that brilliant, the market isn’t liquid and there are often concerns about getting money in and out,” Collings said. “For us, it’s key to stay relatively liquid.”

Banks, Oil Stocks

The market value of shares listed on the Ghana Stock Exchange is $12.8 billion, according to data from the bourse, a fraction of South Africa’s All Share Index at $590 billion, based on Bloomberg data. Average trading volume is about 650,000 shares a day, compared with an average 215 million in South Africa.

The lower trading volume in Ghana means it can take months to carry out orders for share trades, Bendell at Exotix said. Ghana’s pension-reform program may help boost trading by allowing private brokers to manage company retirement plans for the first time, he said.

Ghana Commercial Bank Ltd., the country’s biggest lender with 157 branches, and Ghana Oil Co., which runs a network of filling stations in the West African nation, may be among the biggest gainers, Bendell said. Ghana Commercial’s stock has doubled this year, while Ghana Oil has rallied 59 percent.

Tullow Oil Plc, which owns a 34.7 percent stake in the Jubilee field off Ghana’s western coast, said production will start at 120,000 barrels a day. The field, with as much as 1.8 billion barrels, will make Ghana one of the world’s top 50 oil producers, according to Tullow. Shares in Tullow jumped 98 percent last year and are down 18 percent this year.

Gold, Cocoa

Ghana’s stock rally this quarter has lifted valuations to 15.1 times estimated earnings from 9 times on March 31, Bloomberg data show. Valuations on the MSCI Emerging Market Indexhave fallen in the same period to 11.5 times expected earnings from 13.

“The stock-market valuations are relatively attractive versus sub-Saharan and emerging-market peers, given the country’s growth outlook and political stability,” Bendell said. “There’s a lot of focus on how government will spend its oil income.”

Ghana was the first sub-Saharan African nation to gain independence from Britain, in 1957, and has become the world’s second-biggest cocoa grower and Africa’s largest gold producer after South Africa. President John Atta Mills, who took office in January 2009, served as former military leader Jerry Rawlings’ vice president from 1997 to 2001.

Inflation has slowed from a five-year peak of 20.7 percent in June 2009 to 10.7 percent last month, the 11th consecutive monthly decline. The rate is the lowest since December 2007. The central bank reduced its benchmark interest rate to 15 percent in April and has cut a total of 3.5 percentage points since November.

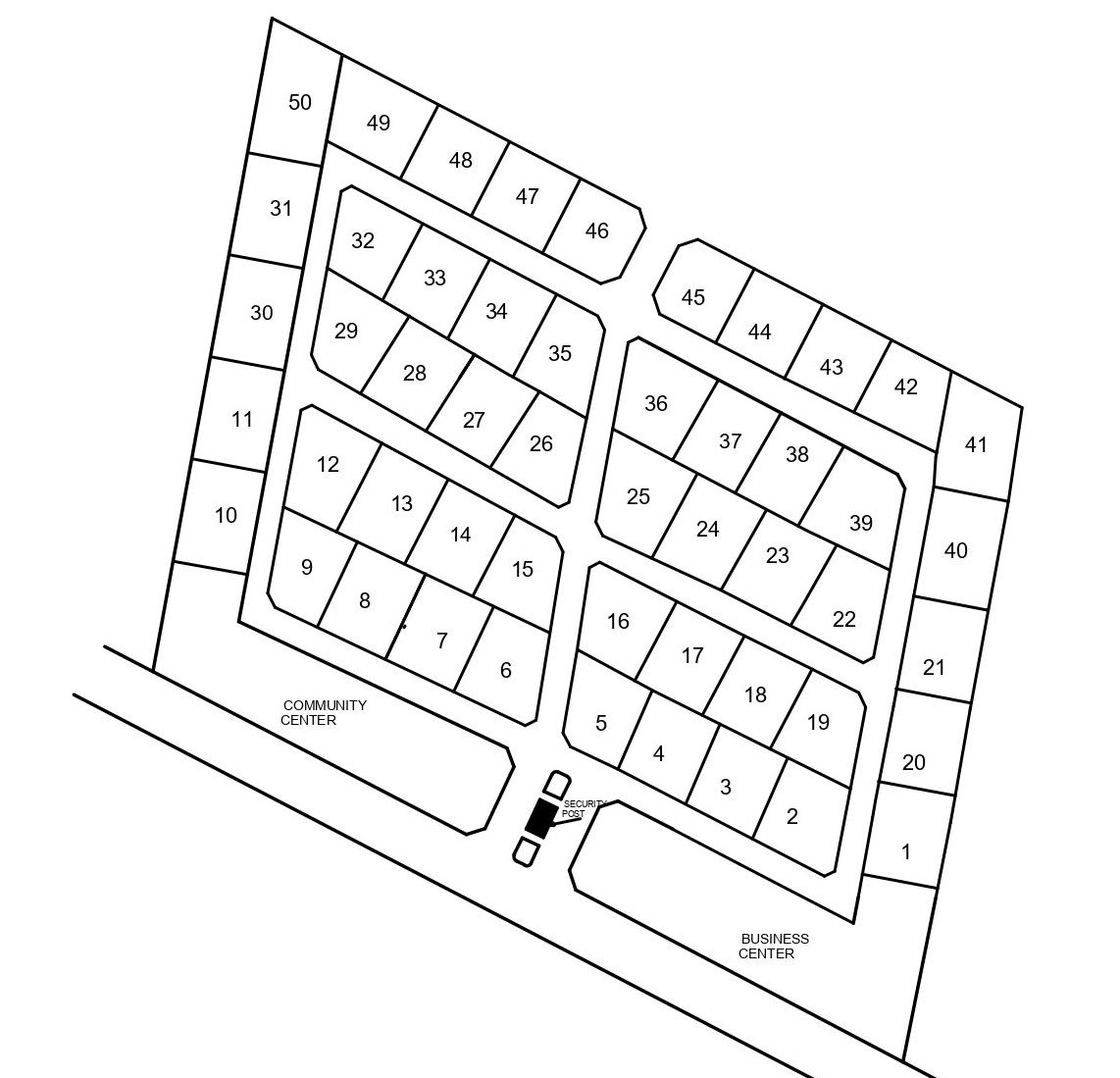

For more information about Africa Tours & Investments register on our websitewww.africafortheafricans.org and contact us.

![ustream_tv_link[1].jpg](/images/libtv/ustream_tv_link[1].jpg)

![LIBradio_180_150[1].jpg](/images/libradio/LIBradio_180_150[1].jpg)